Yes, it is true! If you are coming up this weekend, you can ski...

See link below. This is good news that we can take advantage of this late season snow.

http://www.msnbc.msn.com/id/37364006/ns/local_news-sacramento_ca/

Wednesday, May 26, 2010

Tuesday, May 25, 2010

Wacky weather continues...

Imagine my dismay that we are still getting snow and all of the ski mountains are closed! We have another 3 days of snow in the forecast, then back to the 60's for Memorial Day weekend. The golf courses are open, people are getting their boats summerized, we are pretending that it is warm. I have faith that the 70's are right around the corner. They had better be....

The moisture is very good for our summer boating outlook, though. Hopefully the lakes will stay full through the fall this year and this late spring will snow be well worth it.

If you are interested in our local weather bloggers forecast for this holiday weekend, go to:

www.tahoeweatherdiscussion.com

The moisture is very good for our summer boating outlook, though. Hopefully the lakes will stay full through the fall this year and this late spring will snow be well worth it.

If you are interested in our local weather bloggers forecast for this holiday weekend, go to:

www.tahoeweatherdiscussion.com

Tuesday, May 11, 2010

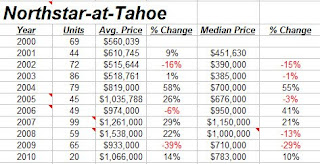

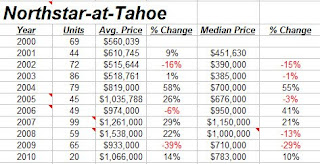

Data for Q1 N. Northstar Market Narrative

Please refer to May 1 posting for narrative of all N. Lake Tahoe Q1 results, here is the data if you are interested in seeing what has been going on in the Northstar market at the beginning of 2010. If you have an interest in receiving the spreadsheet data for the whole N. Tahoe area let me know and I will email it to you.

Saturday, May 1, 2010

North Tahoe Q1 Review - Market Update

This post is thanks to one of my managing brokers Jeff Brown, I thought it was interesting and wanted to share. If you would like the spreadsheets that detail the data mentioned in this narrative, please let me know.

"Reviewing statistics from Q1 2010 is much like reading the news on real estate; one day there is a report indicating improving conditions and offering signs of recovery immediately followed by a different report of historically low sales and continued price regression. One has to assume that given the downward ride over the past few years, any recovery will begin in this manner with the good news slowly overtaking the bad.

Perhaps most important is to recognize that the volume of sales has increased by 81% over Q1 2009 from 156 to 281 units. Perhaps more telling is to note that 107 of these 281 sales were “distressed” sales meaning either REO (post-foreclosure) or short sales (pre-foreclosure). This equates to 38% of all sales versus 26% for the same period in 2009. For the entire Tahoe Sierra MLS, median priced dropped 8% compounding a 33% loss from the previous year.

Speaking more regionally, there are some better stories to tell including Northstar-at-Tahoe where median price rebounded by 10% after 29% and 13% drops each of the past two years. This increase was largely powered by sales in the Village at Northstar which saw an increase in median price of 25%. Some of this is attributable to a price vacuum as the developer sold through remaining inventory at liquidation prices in 2009 while a larger portion is due to the sale of several larger units in 2010 versus the mostly studio , 1- and 2-bedroom sales from the previous year. During the same period, homes at Northstar slid 8%; on par with the greater region.

Elsewhere, Gray’s Crossing has seen the greatest relative jump on sale activity with six homes and five homesites already closed in 2010 and many more of each currently pending sale. This is largely reflective of distressed inventory selling through at prices 45% off peak value for built product and up to 85% for vacant land. This story is remarkably similar to that of Old Greenwood from exactly one year ago. If the pattern holds, all product appropriately priced will sell through quickly while inventory that remains at pricing from 2007 or before will linger. After selling 11 homes in 2009, but one has sold in 2010; the lone sale being a “flip” at par value of one of the 11 from 2009.

Lahontan has traded four homes at values almost identical to 2009 values and approximately 41% off peak value. The regional bell weather, Tahoe Donner, is off 11% from 2009 compounding a 19% drop from the previous year and 34% from peak value.

Active inventory in these communities has reduced to 6-18 months worth though there likely remains significant “shadow” inventory in each community (those wanting to sell but unable to at current values). Given the current pace of sales, the greatest concern for the coming season is a lack of competitively priced inventory. While I imagine the process will be slow, I have hopes that this will eventually lead to a price increases over time.

Finally, Martis Camp continues to be the stalwart of the region selling homesites at a pace even greater than their remarkable 2009. Word is 20 developer homesites have traded in 2010 at an average gross price around $900,000. (The numbers reflected in the attached report are re-sales, posted literal to what is shown in MLS). The word is that there could be as many as 30 construction starts this year – a staggering number in comparison to the rest of the region.

Look forward to an increasingly positive report at the end of Q2."

Thanks Jeff!

Subscribe to:

Posts (Atom)